Fintech startup Tensec Holdings Ltd. wants to transform the way financial services are delivered to small and medium-sized businesses after closing $12 million in seed funding and building what it says will be a real-time, cross-border payments service.

Today’s round was led by Costanoa Ventures and saw participation from Quiet Capital, Willowtree Investments, Cambrian VC, Ignia Partners, Montage Ventures, Renegade Partners and Endeavor Scale Ventures.

The startup is targeting global trading companies, trade compliance consultants, investment firms and forex brokers, giving them a way to enable seamless cross-border transactions and provide banking services to their clients, who are primarily small and medium-sized businesses. To do this, it has created a global financial infrastructure platform that allows them to quickly integrate international payments, FX services, treasury, lending and other services, which were previously only available through traditional banks at high costs.

According to Tensec co-founder and chief executive Helcio Nobre, SMBs facilitate nearly half of all global trade, but find it very difficult to access the types of financial services that larger companies can leverage to grow their businesses. “We are pioneering the model, empowering global trading companies to provide these services directly to their partners, making global trade faster, cheaper and more accessible,” he said.

Most cross-border payments continue to go through traditional banks, which rely on the 40-year-old Society for Worldwide Interbank Financial Telecommunications or Swift network that facilitates transactions between them through its global network. The Swift network is notoriously inefficient, with transactions typically taking days to process and accruing very high costs.

Tensec points out that while there has been significant innovation in terms of consumer and business payments, small and medium-sized businesses still have to rely on decades-old bank wire transfers, despite accounting for something like 40% of the $25 trillion annual trade in physical goods.

The startup believes that the global trading partners of these SMBs are in the best position to change this state of affairs, which is why it is consolidating global payments, hedging services and trade finance into a single platform without any integration work. Simply put, it allows them to offer a range of services to their customers that were previously available only through banks. The actual payments and banking services are provided by local banks that work with Tensec — in the case of the U.S. partners, it is working with Stearns Financial Services Inc.

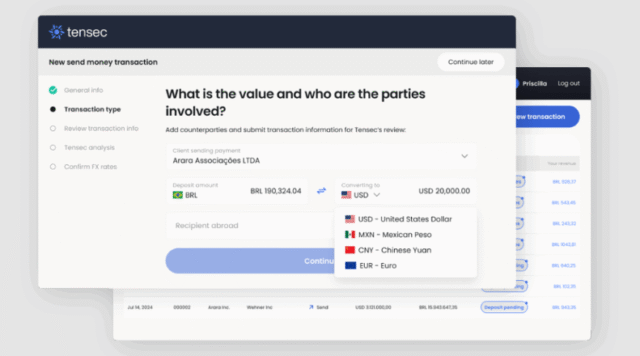

With Tensec’s platform, merchants can onboard their SMB customers in minutes using intelligent know-your-business and know-your-customer verification tools, giving them access to a more efficient payments infrastructure that facilitates transactions in minutes instead of days and at lower costs. It supports transactions in over 150 countries and over 70 global currencies. In addition, they will also be able to offer FX hedging services to capitalize on fluctuating exchange rates, as well as treasury tools to create customizable pricing models and recurring revenue streams.

Tensec’s platform can be integrated into client platforms in just a few minutes and features built-in risk assessments and AI-powered compliance checks.

“Our services enable companies already engaged in global trade to offer their own financial services innovations,” explained Helcio. “This fills a real need and helps their customers thrive.”

Costanoa Ventures partner Amy Cheetham said she was drawn to Tensec because it helps global commercial enterprises better serve their customers. “It’s a win-win, bringing new revenue to commercial enterprises and modern financial tools to small and medium-sized businesses that have been underserved for decades,” she said.

Image: Tensec

Your vote of support is important to us and helps us keep the content free.

One click below supports our mission to provide free, in-depth, and relevant content.

Join our community on YouTube

Join a community of over 15,000 #Cubealumni experts, including Amazon.com CEO Andy Jassy, Dell Technologies Founder and CEO Michael Dell, Intel CEO Pat Gelsinger, and many more luminaries and experts.

THANKS